It’s always something. Wedding. Baby Shower. Graduation. Engagement party. Birthday. How much do we really need, and honestly? How much time do people waste returning gifts that they don’t really need or can’t really use.

Enter Shareswell, a simple, secure platform that allows you to give the gift of stocks, and (can’t resist): CSL knows how to pick ‘em! Founder Emily Washkowitz (’14BUS) tells us about the company that she started as a B School project….and which was the first stock that someone purchased through the platform).

Tell us about the product or service.

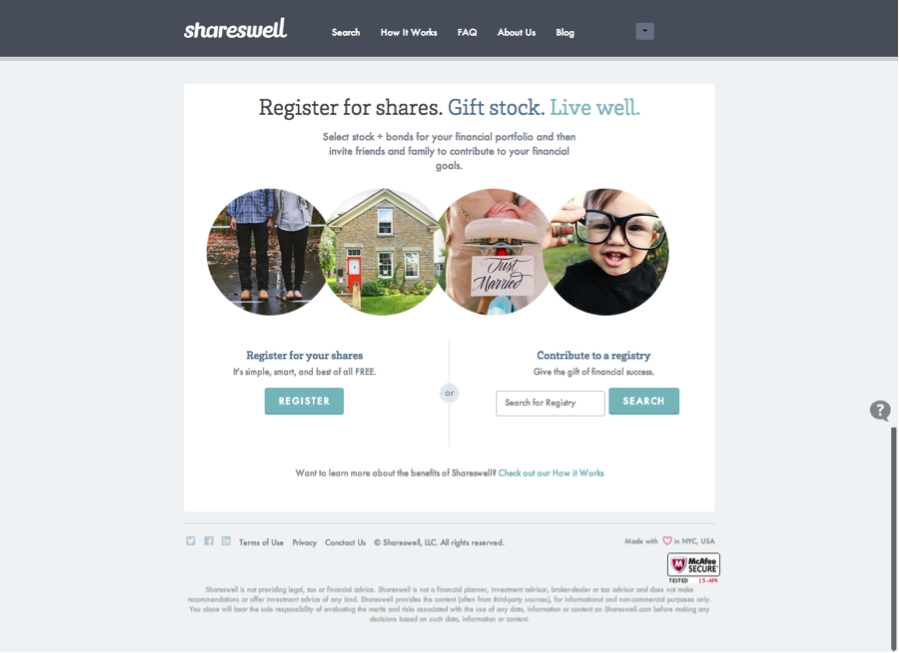

Shareswell is the simple and secure platform for gifting stock online for any occasion. Most people celebrating major milestones create online registries with stores, for items that they often do not want or need. A high percentage of these gifts are ultimately returned for store credit. Instead of going through this roundabout process, Shareswell allows users to create a stock registry and share with family and friends. Shareswell empowers users to reimagine their financial future and enable individuals to give the gift of financial security.

How is it different?

Shareswell is the first online platform for gifting stock. We are focused on any life occasion – weddings, baby showers, graduations and more – and are broker agnostic, meaning we can work with any broker online.

What market are you attacking and how big is it?

We see the market in terms of event verticals and gift proxies. For example, there are on average 1.5 million wedding registries per year with an average of 150 gifts and $100 per gift. If you add baby showers, graduations, and college savings, the market is huge.

What stocks are most popular now that are being gifted?

Users have registered for a range of stocks and ETFs. Tech stocks have been the most frequently gifted stocks on the site. The first stock gifted on Shareswell was Whole Foods.

What is the business model?

Shareswell is free for all users. The business model focuses on working closely with partners and brokers to monetize through a variety of paid placements, affiliate fees and sponsorships.

What are the milestones that you plan to achieve within six months?

For the next six months, we are laser focused on customer acquisition. We have milestones in place for both the number of registries and the number of stock gifts made.

Tell us about your experience with the Columbia Startup Lab thus far and your decision to apply.

I launched Shareswell while at Columbia Business School and thought the Columbia Startup Lab would be a great way to continue working on Shareswell and stay connected with Columbia. The CSL has provided great resources and an inspiring network from across the entire University.

If you could be put in touch with one investor in the New York community who would it be and why?

Even though I have not started fundraising yet, I am fortunate to have already met a lot of the investors who I really admire, like David Tisch and Stuart Ellman. Other key investors in the New York community that I hope to meet are James Robinson III, Roger Ehrenberg and Josh Kopelman. They have been instrumental and central to the New York startup community and are experts when it comes to fintech.

Why are you launching your business in New York?

I was born and raised in Manhattan and for Shareswell, a fintech company, there is no better place to launch and operate than New York. We are at the center of fintech innovation and, on any given day, can meet with our partners and advisors in person.

What’s your favorite summer time beach destination close to NYC?

I am not a big beach person but at 6 pm dogs are allowed on many beaches so I like to go with my dog, Wooly, to the beach in Amagansett.