New York is a fashion town. Actually, it’s a fashion capital in a $1.2 trillion industry. Since it’s also a technology hub and home to many of the major fashion brands and retailers, it was only a matter of time before the three converged into an accelerator program to foster some of the best emerging fashion tech that was naturally drawn to New York. That’s the idea behind the New York Fashion Tech Lab, a collaboration between the Partnership Fund for New York City, Kay Koplovitz’s Springboard Enterprises and major fashion retailers, is to focus on targeting early and growth stage companies that are innovating at the intersection of fashion, retail, and technology.

Three industries that all converges in New York, making it the natural home for the Lab.

Some 400 companies applied to participate in this inaugural program that was headed by Mark Chou, a Wharton grad who was Program Director for the FinTech Innovation Lab and who also formerly worked for Ralph Lauren. He was actually taking some time off when Partnership Fund President Maria Gotsch tapped him to take the Managing Director spot.

“Our main focus was to connect eight promising companies with nine of the biggest and most respected fashion retailers and brands,” said Chou. As with any good accelerator worth its salt, it’s all about mentorship, and pilot programs that resonate with businesses and the problems they need to solve.

You won’t find fashion here, but you will get a first look at some of the companies that are helping to reshape the fashion world and changing the way you buy clothes. And when you look at them in total, what you’ll also see is an the end-to-end fashion tech solution for brands, designers and retailers.

MEET THE 8 HOTTEST FASHIONTECH COMPANIES IN NYC RIGHT NOW

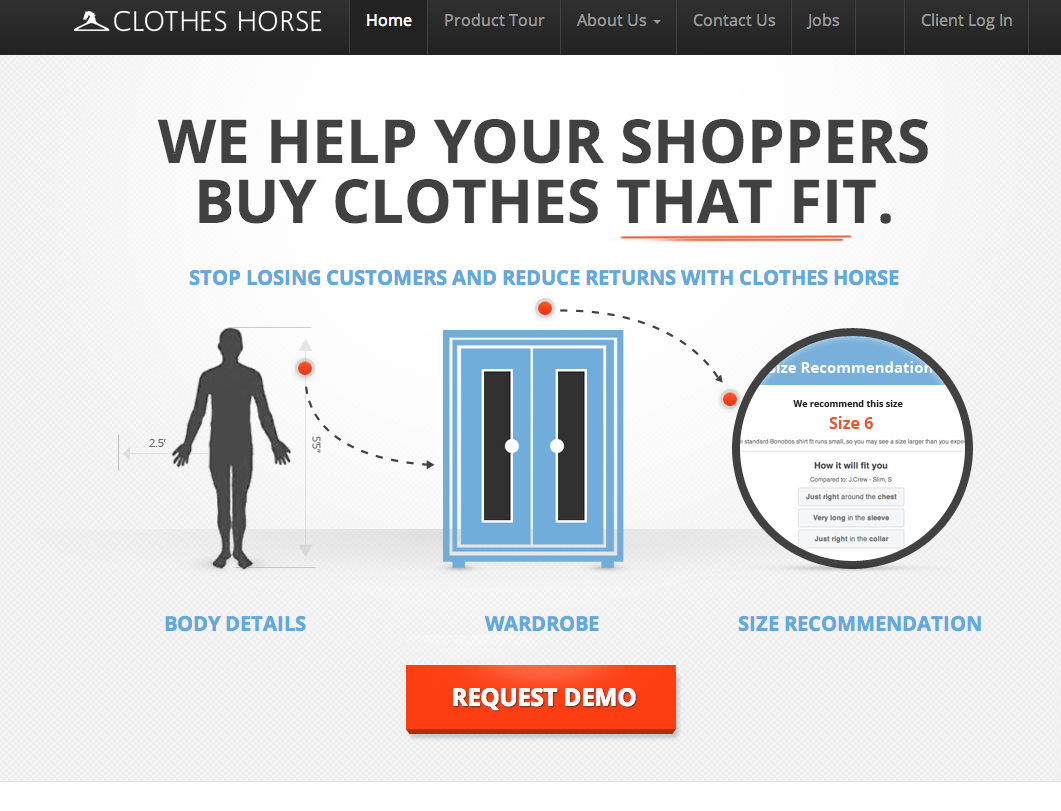

Clothes Horse

If the shoe fits…Yeah, yeah, yeah, but it’s the clothes that make the person, and buying them online has been something of a crapshoot. Clothes Horse is solving that problem: the company’s core product is a recommendation engine that retails embed on their site and that recommends sizes, based on a shopper’s body details and favorite clothes – and of course, a predictive algorithm. The end result: a better fit, and a better fit means few returns, which has always been a headache for retailers.

“Our client have seen a 9-1/2% decrease in return 9% lift in revenue,” said co-founder Vikram Venkatraman, who is also a DreamIt Ventures Accelerator alum.

Between their analytics, competitive intelligence, design and propriety data(which they call Clothes Horse Insights), no one else has a product quite like Clothes Horse, and “the only place where you can build a company like this is in New York, where all businesses are based,”Venkatraman added. “We have competitors in other parts of the world, and they suffer as a result of it.” The company’s biggest differentiator: “The number of case studies we’ve done. Our product is a 10X ROI for our customers.” Their current clients include 30+ world-class retailers, including Anthropologie, Bluefly, Steven Alan, Nicole Miller, GANT and Frank & Oak, the fastest growing retailer ever.

“We think of this as a $3-$10 billion problem – maybe even larger. This is the lynchpin that’s holding retailers back – it’s all right there in the fit.”

Stylinity

Stylinity is the first shoppable selfie. Here’s how it works: You take a selfie (like that ever happens), Stylinity provides a click-to-by bar code, so it’s easy for friends or your selfie admirers to find out where to buy it – and make the purchase. Of course it seamlessly integrates with ecommerce platforms – pun intended. The results: increased engagement and revenue for all parties: retailers do reward their best customers/influencers.

In a world where Americans share 100 million selfies every day, seems like a win all around. But it wasn’t so obvious when Tadd Spering founded the company in 2012. Potential investors were dubious.

“They thought the premise was flawed,” said Spering. They couldn’t understand the concept of people taking pictures of themselves, much less share them across social networks.

Did we mention that Americans share 100 million of them a day?

“We’re really a platform play, driving social commerce with selfies,” said Spering, who moved to New York from Miami in 2004. “We also capture a lot of great data, and what people like and why. We can also recommend styles and sizing. We can do a lot of cool things with the algorithm – and the data.”

“It’s the capital of Earth,” he corrected us.

While they’re currently targeting the fashion market, that’s just the tip of the iceberg. “It’s a $20 billion market domestically, and $30 billion internationally. Beauty is another $30 billion.”

So he does have plans for expansion. But doesn’t plan on leaving New York any time soon, or ever.

“It’s the capital of Earth,” he said.

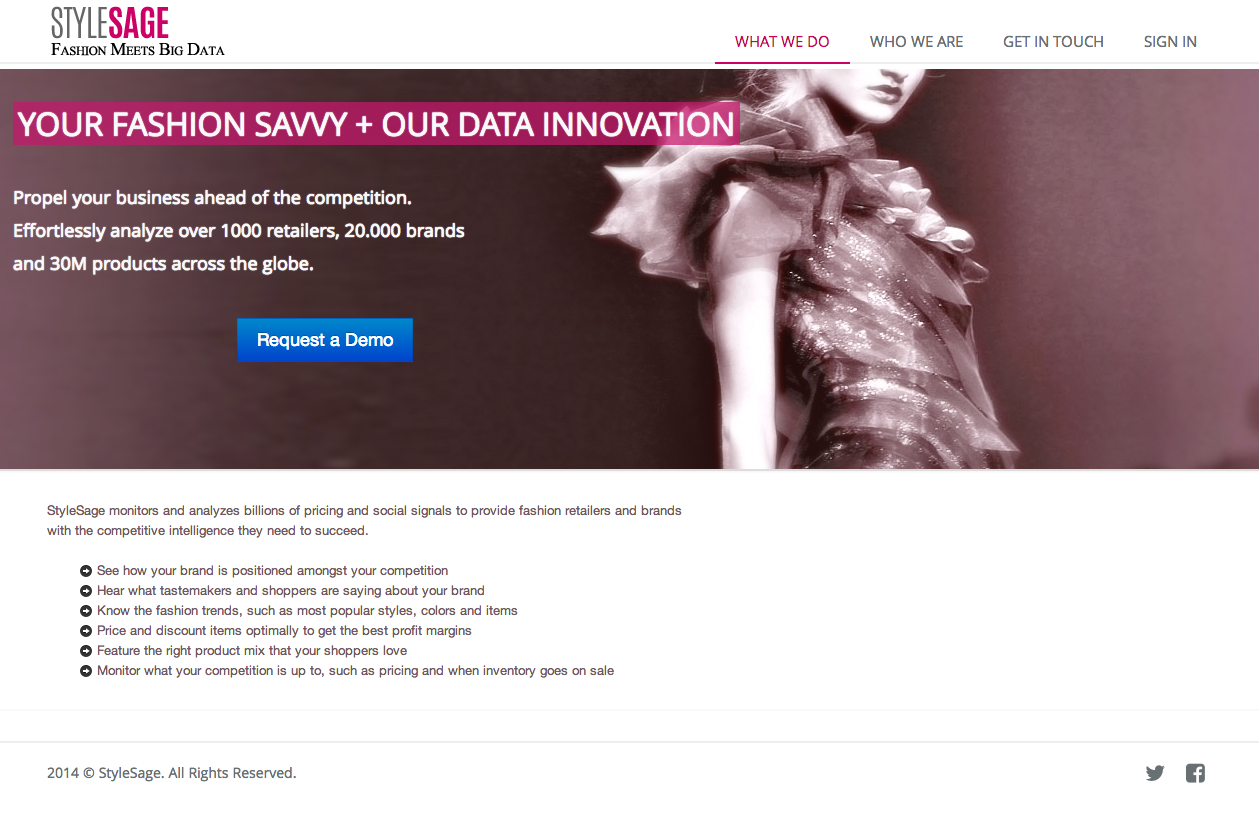

StyleSage

Founded last fall, StyleSage, is already being hailed as the “Bloomberg for Fashion.” The beta platform analyzes over 1000 retailers, 23,000 brands, and 31M products across 17 countries and deconstructs their pricing, assortment, and promotions strategies as well as trending styles.

The strategic analytics platform helps fashion retailers and brands with critical in-and-next season decisions in local and global markets, is already being hailed as the “Bloomberg News Fashion,” although we like to think of it as the “Nielsen of What’s Next.” The beta platform analyzes over 1000 retailers, 23,000 brands, and 31M products across 17 countries and deconstructs their pricing, assortment, and promotions strategies as well as trending styles. With two pilots currently in place, they’re answering the questions retailers and brands want to know:

1. What do consumers actually want to buy next season?

2. How you should price your merchandise correctly?

3. How much do you stock?

4. Where to allocate your inventory?

The team is international (New York, Madrid and Paris) and so is their market.

“We look at the business across the globe and at emerging markets,” founder Jade Huang explained. “Russia, China, Brazil. We’re also fortifying our presence in existing markets.”

The team itself is a convergence of design and analytics. Huang studied fashion design while at Parsons, then switched to designing for online, while her two co-founders have backgrounds in analytics.

“Michael Kors is in 80 countries. It’s complex to get it all right and maximize profit margins. No one has gotten that right yet.”

It’s a puzzle in a $1 billion available serviceable market, being scrutinized by a team with all of the right parts, looking at all of the right pieces.

Stylit

Stylit is a free online stylist, and personal styling tool that helps both brands and retailers. The patented styling platform marries machine learning with that je ne sais quoi of actual stylists. It’s a curated recommendation and idea (and sales) engine where users receive contextual head-to-toe recommendations tailored to their tastes and needs. They love it (there are currently 100,000 users and 40 stylists signed on) and what retailer doesn’t love the upsell?

Suggestions are tailored to a user’s style, preferences and budget, and happy customers are responding directly with Stylit, telling them why they purchased what they did.

“We all get emails about sales, but sales email don’t really speak to you,” Nissim explained. No, it’s just not the same as advice from a stylist, although the company does intend to emphasize sales in the future. Everyone loves sales, and it’s definitely in the plan.

The target market is 26-34 year olds in the US.

The company was founded in Israel two years ago, and invited to apply to the program. The next step for Stylit is to white label the solution for brands and retailers for a more personalized, smarter shopping experience.

Stylit is fueling the future of fashion search and predictive styling, while improving the customer experience. And that’s always a win.

Perch

Perch is a revolutionary interactive technology for the retail environment – a 3D sensing projection surface that allows retailers to provide not only the merchandise, but the interactive content that formerly only resided online. Now, it’s right there, in store, on the product display, with built-in shopper analytics.

It’s cool. You lift the product from the display table and all of the information is projected where the product formerly sat: advertising, marketing, product information. It’s all about connecting the shopping experience with what you’d expect from website and TV, exploring it through rich media content, and putting all of that information at the point-of-purchase, where it can help to make the sale.

Over are the days of static in-store advertising and marketing campaigns. We’re sold! Retailers and brands can also change the narratives and experiences whenever they need to. “It’s about surprising and delighting customers,” senior producer Kate Watson explained.

When Kate Spade introduced the new travel destination line, Capri, the company extended the content beyond the web and right into the Kate Spade stores, via Perch, refreshing the content every month.

Quirky also features Perch in their showroom for retailers who come in the Quirky products.

The target demographic at the consumer level is Millenials, but Perch’s appeal extends beyond them.

“It’s really about product knowledge and engagement. And it’s really playful.”

There are currently involved with some 40 projects, and can be found in ten Kate Spade stores. Cole Haan, Kiehl’s and Clark’s are also clients.

Founded in New York, the company has put down roots here, what with all of the brands and retailers here, be it fashion, cosmetics, athletic wear. Not to mention the tech companies. Something for everyone, and that’s what Perch is offering, too.

Trendalytics

Trendalytics is a visual analytics platform that offers more accurate insights on brand positioning and product mix and measures how merchandise trends resonate with consumers. The company surfaces relevant signals for the fashion industry by identifying and synthesizing product attributes (e.g., maxi dresses, combat boots) across social chatter, search behavior and shared images to reveal actionable insights on product assortments, regional demand and seasonality.

To break it down: the industry hasn’t changed in a couple of hundred years, according to Chief Revenue Officer Larry Nipon. There has been a huge information gap between what people are thinking about and doing before they do it. Meanwhile, buyers have been basing their decisions on what has already been done, rather than what people are thinking of doing. And hasn’t it always been the earmark of a winner to skate to where the puck is going, not where it has already been. Which is precisely what this Entrepreneurs Roundtable Accelerator company is doing, and thus, cutting down on the 50% of retail inventory that ends up having to be sold at discount, despite the fact that the apparel industry spends $17 billion on software and IT services each year, as founder Karen Moon points out.

Trendalytics sits in the middle of that time curve, as the missing piece: the company developed the platform with insights and feedback from over 100 professionals across 40 brands and retailers and identifies customer patterns both globally and more importantly, regionally, which, at the end of the day, is where retail resides, after all.

Suddenlee

You know customers. They want what they want, when they want it. A big part of shopping is the immediate gratification element. It’s not an easy thing to do online, but Suddenlee comes damned close.

Suddenlee is a membership program that provides affordable next-day delivery from specialty stores and fashion brands. Their shopping logistics technology enables efficient merchandise procurement, processing and shipping for next day delivery on a regional basis. As a result, consumers are able to receive the products they want, from the brands they love, when they want them. Retailers are able to increase sales and customer satisfaction by offering an expedited service level at a cost that is comparable to standard fulfillment and shipping, thus solving one of the touch points of the cart abandonment issue: immediate gratification. Or damned close to it.

Nineteenth Amendment

Fashion has always been a chicken-or-egg problem: which comes first, the fashion or the consumer? Well, we know the way it has always been done, but Nineteenth Amendment is inverting the model.

Nineteenth Amendment is a marketplace for fashion designers to showcase and sell their design through an interactive, crowdsourcing model. Designer create, and customers discover, critique and even pre-purchase designs. With this kind of marketplace that helps brands with marketing and operations by providing US manufacturing and fulfillment as a service, along with consumer sales analytics to make smarter business decisions, the idea is that emerging brands no longer have to hold thousands in inventory. And shoppers get precisely what they want. And that element of exclusivity only adds to the cache.