Now that the SEC and FINRA have finally gotten tech friendlier, you just knew that some savvy entrepreneurs were going to step up to the plate and make it easy to bring the power of the Internet – and their own connections – directly to financial advisors.

AdvisorCONNECT is on it. You’ve worked hard to build your network. Now, see how it can work for you. AdvisorCONNECT has the tools, and co-founders Jeff Tomkins and Jimmy Lyons are here to tell us how their platform will help identify qualified prospects, referrals, centers of influence – and there’s more where that came from. Read on….

Tell us about the decision to apply for ER Accelerator.

We’re at a pivotal point in our company’s development. We’ve confirmed product-market fit and are looking for structured resources to help us take our growth to the next level. An NYC-based accelerator with an unparalleled network and a reputation for helping start-ups take advantage of the thriving Silicon Alley ecosystem—ERA was the perfect fit for us.

Tell us about your product..

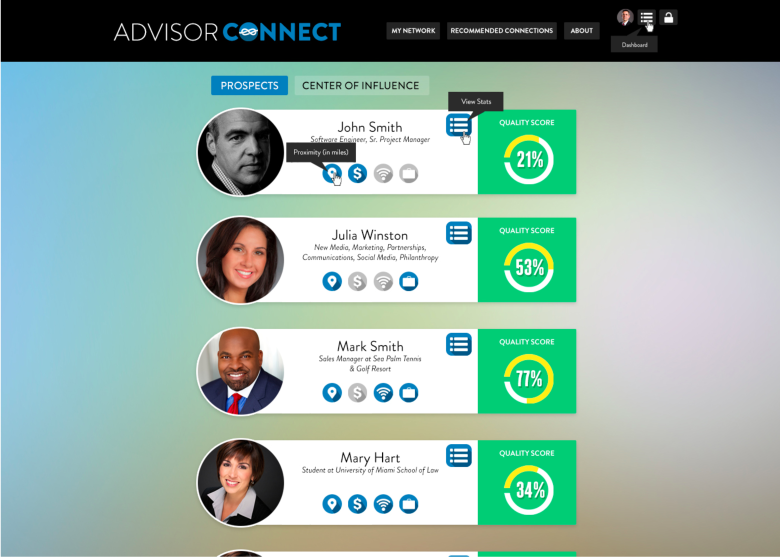

advisorCONNECT is a social relationship management platform (SRM) that helps financial advisors find new clients. The platform provides advisors new tools to stay current with their networks, including money-in-motion alerts and a proprietary wealth graph, which identifies qualified prospects, referrals, and centers of influence.

How is it different?

advisorCONNECT helps financial advisors, long constrained by regulatory restrictions, to tap into the power of the internet for business development. We’re like a Hinge for advisors: we help match them with the right prospective clients, hidden within their own social networks.

Co-Founders

AdvisorConnect

What market are you attacking and how big is it?

We decided to focus our efforts in financial services in large part because we saw a huge opportunity in an industry that was just starting to embrace technology—social media in particular—as the SEC and FINRA have only recently started to loosen their stranglehold on advisors’ use of these channels. There are well over a million potential customers just in the niche advisor and insurance slice of financial services alone.

What is the business model?

We’re an enterprise SaaS platform.

What are the milestones that you plan to achieve within 6 months?

To grow our pilots from one (we are currently working with one of the top five largest broker dealers) to five partners. We are laser-focused on delivering maximum value to our partners and having the additional pilots will help us get there more quickly. Like any other start-up, we are working hard to attract top talent to our team.

If you could be put in touch with one investor in the New York community who would it be and why?

Our ideal match would be with a strategic investor in financial services, who shares our vision of using technology to enhance both business development and relationship management.

What is your take on the current scene in New York today?

The NYC tech scene is becoming more and more attractive to entrepreneurs as the community grows, investment increases, and the infrastructure for entrepreneurialism continues to be supported by the great companies and organizations in this space. We have many major institutions—real estate, advertising, finance, that are all looking to further their use of technology to increase efficiencies, customer experience, and by extension, their bottom lines. We have nothing but high expectations for the future of this eco-system.

How will being in NYC help your startup?

There’s no better place in the world to headquarter a financial services start-up than New York. It gives us access to the executives, investors, and partners that have the domain experience and network to help us to rapidly grow our business.

What’s your preferred summer escape, beach or mountains?

Beach for sure! There’s nothing more tranquil than being near or (ideally) on the water.