Recently, the question of what makes a business a startup versus a small business came up. I generally play fast and loose with definitions. I switch up accelerators with incubators and refer to growth hackers as marketers. But when it comes to the small business versus startup divide, I think the distinction is important enough to be more exact with the wording.

What constitutes a small business is something we can all generally agree with even if the details may differ. Regardless of the legal definitions that vary from country to country, a small business is one that has few employees generating upwards of up to a few million dollars in annual revenue. When we say a few employees, that could be anywhere from one to fifty persons.

When you think about startups, they also have few employees producing a small amount (or no amount) of revenue. That sounds like a small business given our loose definition above. However, there is one very critical difference that differentiates a startup from a small business.

Steve Blank knows startups, having been involved as a founder, mentor, investor, and advisor focused in the software technology industry. He has possibly the best definition of what is a startup in all the literature I have read on the topic. He states:

A startup is an organization formed to search for a repeatable and scalable business model.

It is as elegant as it is a simple explanation as to what a startup is versus a small business. Simply put, the typical small business knows its business model from day one. The market is proven, the product is well understood, enough customers exist, and the revenue channels are established. Think of most brick and mortar stores, services firms, franchises, and professional industries.

In a startup, some of these things may be known, but most will be questionable. The biggest question marks at first are usually around the market and product. As the product and market become clearer, the next question is one of customer and distribution, or the scaling part of the startup. Yes, small businesses have scaling questions as well, but they generally start with a very clear idea of the market and product. They are ahead of the curve, so to speak, over startups.

You may have noticed I have made no reference to the tech industry. That is because tech has no exclusive license to the term. Biotech, energy, consumer products, and other industries also have plenty of businesses that are legitimate startups. That is because the industry itself does not matter, what matters is that the solution itself is novel and innovative enough to put into question whether a scalable model is even feasible. No one thought vitamin enhanced bottled water was a good idea initially and dismissed it as a niche product, yet Energy Brands became a $4 billion company. No one thought you could start a new auto company with highly speculative battery technology, but today Tesla Motor Company is a big time public company that has no shortage of customers and is about to turn a profit.

The other thing you might have noticed is that I made no mention of venture capital firms. They are an important feature of the startup industry, but are not a requirement. The nature of VC funding is that it allows entrepreneurs to take greater risks, providing a runway to experiment and explore different methods to finding that scalable business model. In that sense, it accelerates the rate of innovation and the introduction of go-to-market technologies and products.

Some have pointed out that VC’s do not invest in small businesses. That is true to an extent, but you have to remember that VC’s are in the scaling business, so they are interested in multiples when thinking of returns on the investments they make. Small businesses generally have more modest returns because they are not necessarily creating new markets or categories. Even in cases where the market is established, the other aspect of startups is their focus on scaling and hyper growth. It is growth and scale that enables VC’s to potentially lock in huge returns for their LP’s; the type of returns that would make the venture asset class appealing as an investment. Small businesses, simply put, do not generate comparable returns.

At this point, you might be wondering if all these tech startups that are emerging of late are really startups given the above discussion. I have been on the record as saying many of these so-called startups are really small businesses whose storefront happens to be a website or mobile presence. There is little that is either innovative or unknown about the product or the market. On this point, I agree that many of these “no math” startups really need to get a handle on their business model and focus on revenue generation. That is why I understand the confusion some small business owners have when they look at the tech startup scene and ask what is the difference. The fact that VC’s are investing in these types of startups is really head shaking, but I chalk that up to the fact that many VC’s are grasping at straws at this point to buffer subpar returns.

What this means as an entrepreneur is you should think hard about whether your idea is a startup or a small business. The distinction matters as it alters the resources and the path you take in building a successful, sustainable business. Not understanding the difference can cause strategic stumbles, slow down incoming capital, and impact cash flow. And if you have any doubts, you are going to be better off with having money on your mind, and by money I mean revenue. Remember, you are ultimately creating a business, the vehicle by which the world will find and use your solution.

This article was originally publishing on Strong Opinions, a blog by Birch Ventures for the NYC tech startup community.

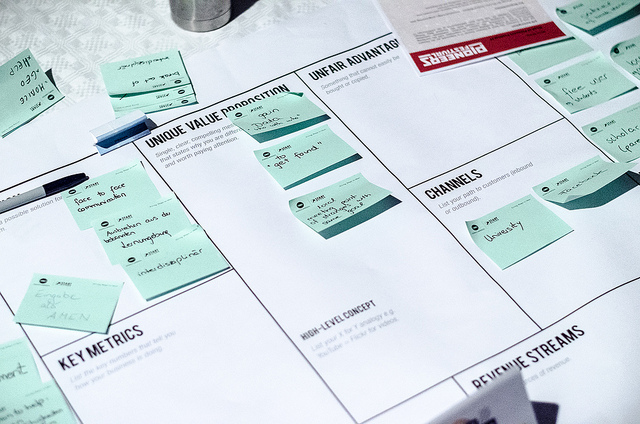

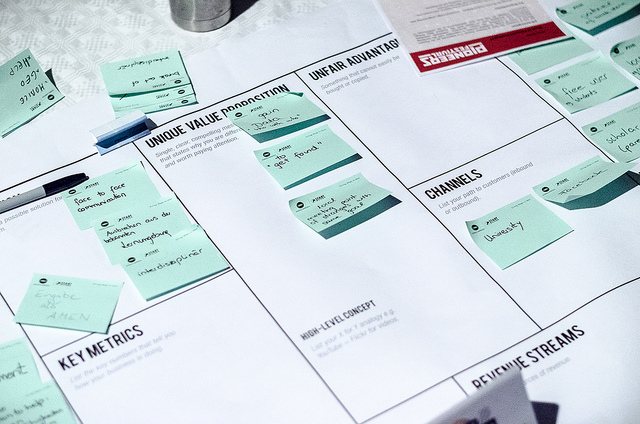

Image credit: CC by Heisenberg Media