A limited liability is a type of partnership. Often referred to as a ‘hybrid’ as far as legal entities are concerned, the limited liability company protects company owners against any personal liability, should something go awry with a company.

How the LLC Came To Be

Many would-be business owners may be surprised to know that the LLC is a form of business that’s relatively new, at least to the United States. However, the LLC has existed for many years in other countries. It was only in 1977 that the first state, Wyoming, enacted LLC legislation in order to attract capital to the state. Florida was not far behind, enacting its own statute in 1982.

But the fact remained that many states at this time had little reason to form LLCs. This was because no one was sure whether or not it would be treated as a corporation or as a partnership, as far as the IRS was concerned. It wouldn’t be until 1988 that a ruling was handed down by the IRS, stating that LLCs would be regarded as partnerships, at least in Wyoming. Once this definition had been officially announced, virtually all remaining states that had not previously enacted LLC statutes chose to do so. Today, the LLC is one of the most broadly-recognized business forms in existence. But interestingly, legal issues surrounding this entity continue to be developed.

LLC Formation

For those wishing to form an LLC, Articles of Organization must be filed. This is an important legal process. However, as firms like Legalzoom point out, it is also a complex one, with many potential risks as well as benefits to the would-be business owner. There are also many responsibilities associated with the filing Articles of Organization, and several implications that they should not be filed in accordance with the law. This is why many experts recommend that anyone wanting to form an LLC do so with the help of a legal professional.

Understanding How The LLC Differs From Other Business Entities

The LLC combines elements of the general partnership with those of limited partnerships and corporations. That said, there are several characteristics that anyone wishing to form a basic LLC should be aware of prior to filing Articles of Organization.

The LLC is, essentially, a three-part organization consisting of managers, members and employees. Company management is in the hands of either managers or members, depending on the decision of the company owner. Regardless of who is managing the company, the LLC designation means that none of the aforementioned three groups can be held personally liable for the obligations or debts of the company. However, this also means that the LLC is subject to the same reporting requirements, record keeping and disclosures that are required of general partnerships.

Some Information That Must Be Included In The Articles of Organization

When filing the Articles of Organization for an LLC, the “LLC” term must be included in the company’s name. An example of this would be “Wendy’s Windows, LLC.” In addition to the name, the company owner must state the reasons for the LLC being formed, as well as the company’s street address.

The names and street addresses of those individuals who cannot be designated as managers or members should be included in Articles of Organization application. However, there is an exception to this rule: when an LLC is going to be managed by members, names and street addresses of these individuals are to be included in the document along with a statement that members will be managing the company.

Do You Need A PLLC?

A Professional Limited Liability Company, or PLLC, is reserved for those professions who require a license. Some examples are an accountant, chiropractor or architect. In fact, a regular LLC is not allowed for these types of businesses. The laws of the PLLC vary by state, but the requirements that need to be met are typically the same.

To begin with, the licensing board in your state must approve the Articles of Organization. This is an additional step that may take time, which makes the forming of a PLLC longer than a basic LLC. All required documents must be organized and signed by the licensed professionals themselves. Once approval from the licensing board is given, all documents, including the Articles of Organization, must be filed with the Secretary of State.

While extensive, this article doesn’t cover all that anyone needs to know regarding the formation of LLCs. This business entity exists in more than two types. Also, several state and federal agencies may need to be contacted throughout the process of forming your company. This is why it is so strongly recommended that individuals obtain the help of legal professionals wherever possible to ensure the accurate and appropriate filing of all required documents.

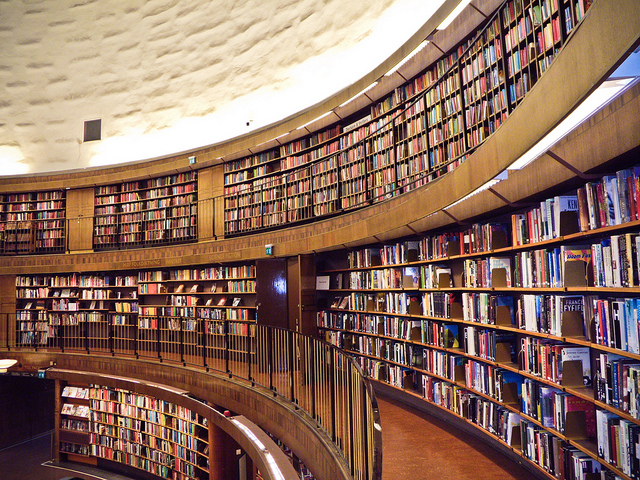

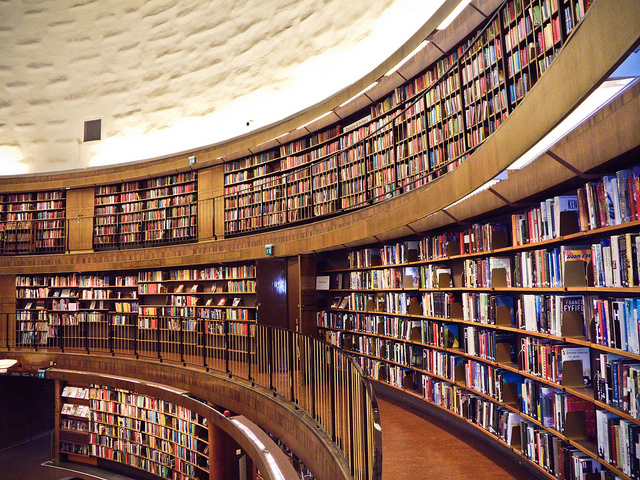

Image credit: CC by Samantha Marx