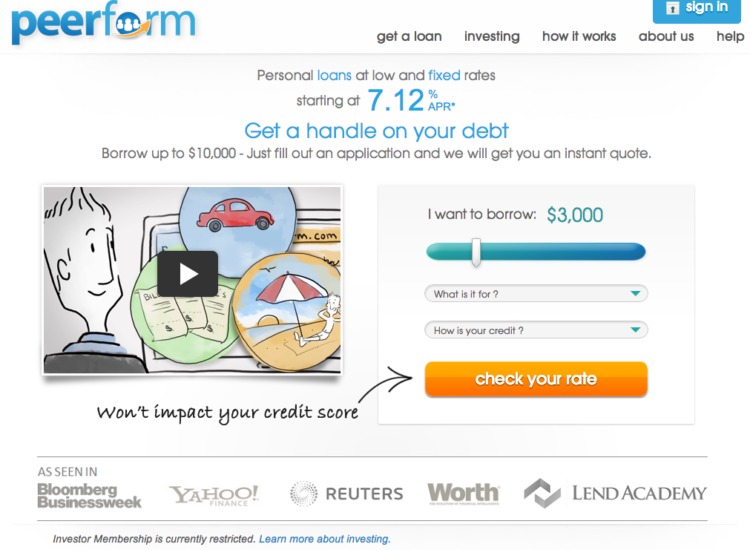

Peerform, a New York City based peer-to-peer lending startup, has raised $1m in seed funding. The round was led by Corporest Development, a European investment firm.

Peerform was founded in 2010 by Mikael Rapaport and Meytal Benichou, experienced finance professionals who left investment banks (Cantor Fitzgerald and Societe Generale, respectively) with a plan to disrupt the personal loans market. The P2P lending platform they developed uses a Loan Analyzer to match borrowers to accredited investors, thereby offering private investors access to a ‘personal loans’ asset class.

It’s an asset class with a lot of potential. The P2P lending market has grown dramatically since British startup Zopa launched its P2P platform in 2005. The credit crunch of 2008 and the subsequent recession encouraged the growth of alternative financing models, including P2P lending. Research by market research firm IBISWorld suggests that the US P2P lending market grew by a staggering 176.6% per year between 2008 and 2013.

The recession may have ended, but the popularity of the P2P lending model hasn’t dwindled. Given the opportunities this growth market presents, it should come as no surprise that Peerform could have its work cut out, with other companies already racing to scale up quickly and corner the P2P lending market.

Lending Club, one of Peerform’s largest US competitors, has raised more than $200m since it launched in 2007, and has facilitated more than $3.8 billion in personal loans. Its investors include Union Square Ventures, Google, Foundation Capital, Morgenthaler Ventures, Norwest Venture Partners and Canaan Partners.

Prosper.com, Peerform’s other major competitor, has raised $119.9 million in venture capital and facilitated $1bn in loan originations. Investors in include Sequoia Capital, Draper Fisher Jurveston, Crosslink Capital, Accel, and Benchmark.

Despite these large, established competitors, the size of the P2P lending market means it is still possible that Peerform can carve out a niche for itself. Judging by comments from Peerform’s new Chairman, Gregg M. Schoenberg, the niche the company is targeting could be those borrowers rejected by the other platforms. “At present, far too many solid borrower candidates are turned away by the other P2P platforms,” said Schoenberg. With Lending Club rejecting more than 50% of the borrower applications it receives, Peerform’s ‘niche’ target market could actually be rather large.