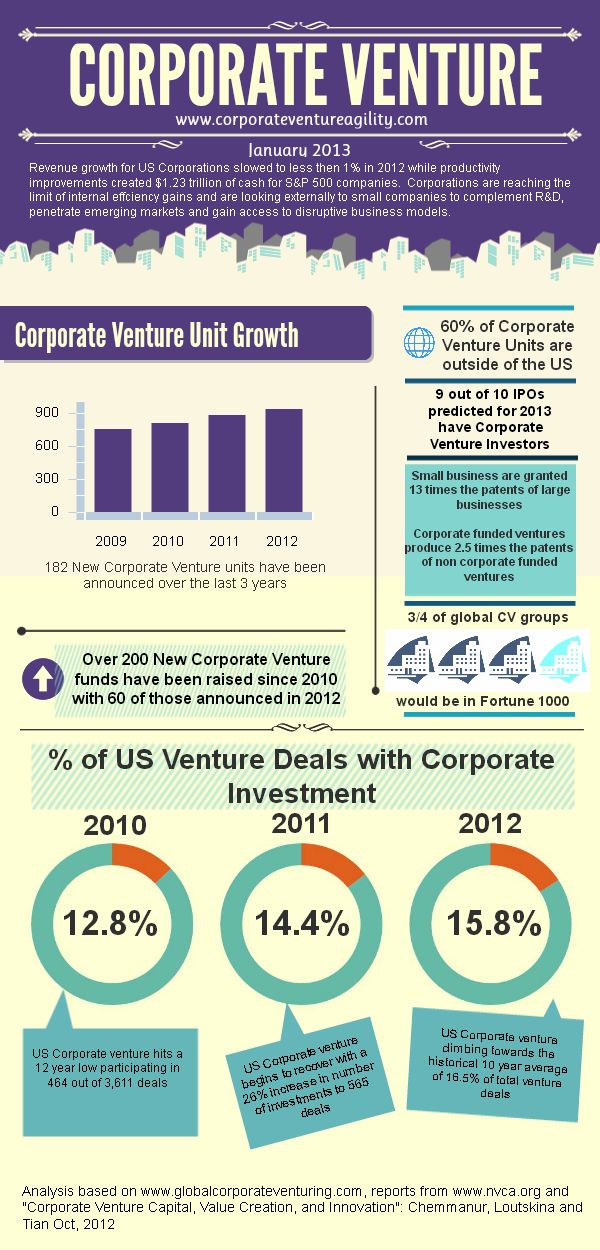

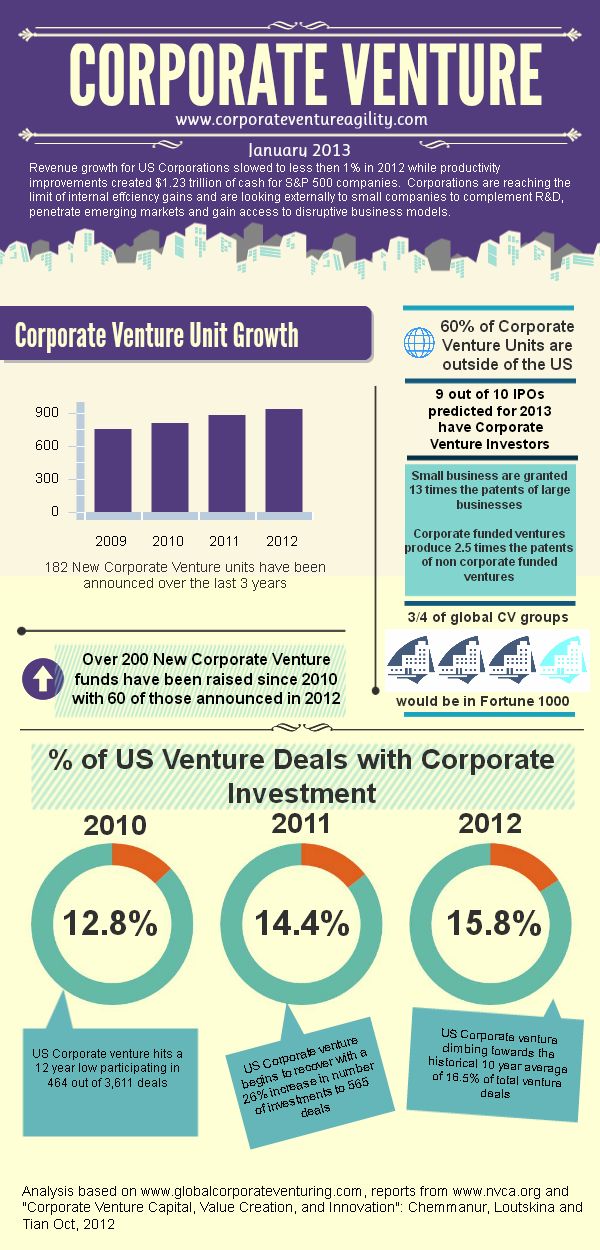

Companies are looking for new ways to be creative and innovative in the competitive marketplace. There are positive and negative viewpoints where corporate ventures are concerned, but a recent analysis by Global Corporate Venturing shows that revenue growth for US Corporations slowed to less then 1 percent in 2012, while productivity improvements created $1.23 trillion in cash for S&P 500 companies. Ultimately, larger corporations are looking to the smaller companies to complement R&D, penetrate emerging markets and to gain access to disruptive business models. Corporate-funded ventures produce more than double the number of patents than do non corporate funded ventures.

While corporate ventures can be risky, when done right, they can be very successful and profitable. And it’s a growing trend: over 200 new corporate venture funds have been raised since 2010, with over 60 of them announced in 2012 alone. Every decision requires thought and research. Check out the infographic below for more information and insights about corporate ventures.

Easy to tweet:

60% of Corporate Venture units are outside of the US Tweet this

9 out of 10 projected IPOs have corporate venture investors Tweet this

Corporate funded ventures produce 2.5x the patents of non corporate funded ventures Tweet this

182 new corporate venture units have been announced over the last 3 years Tweet this

Over 200 New Corporate venture funds have been raised since 2010 Tweet this