Today we take a look at the state of venture capital and angel funding during the all of February, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel, Series A, Series B, and Series C+).

Click here for the next slide from your mobile or tablet

Key Takeaways:

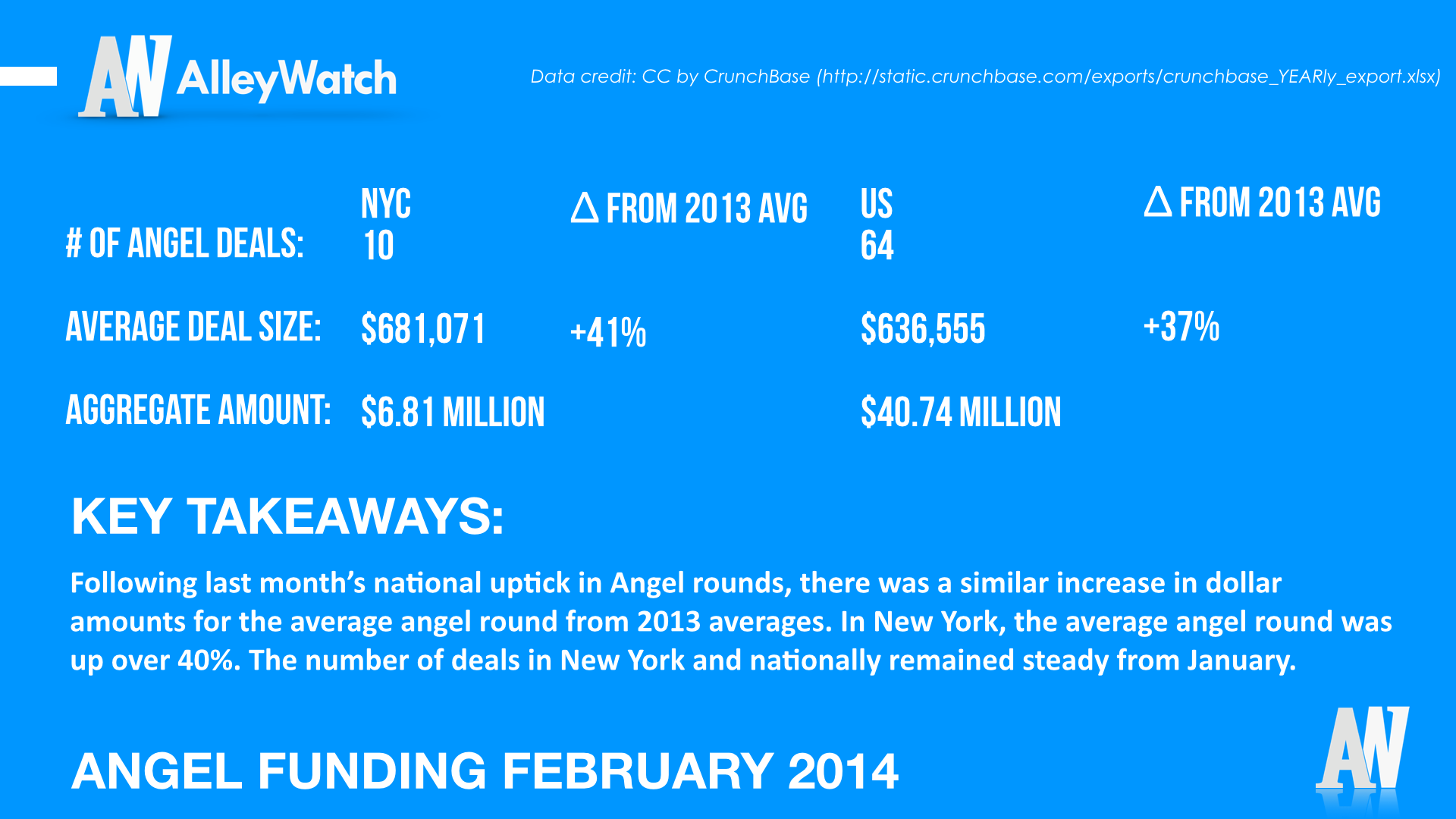

Following last month’s national uptick in Angel rounds, there was a similar increase in dollar amounts for the average angel round from 2013 averages. In New York, the average angel round was up over 40%. The number of deals in New York and nationally remained steady from January.

For your tweeting convenience:

Average Angel round in NYC for February was $681k, up 41% Tweet this

Average Angel round in the US for February was $637k, up 37% Tweet this

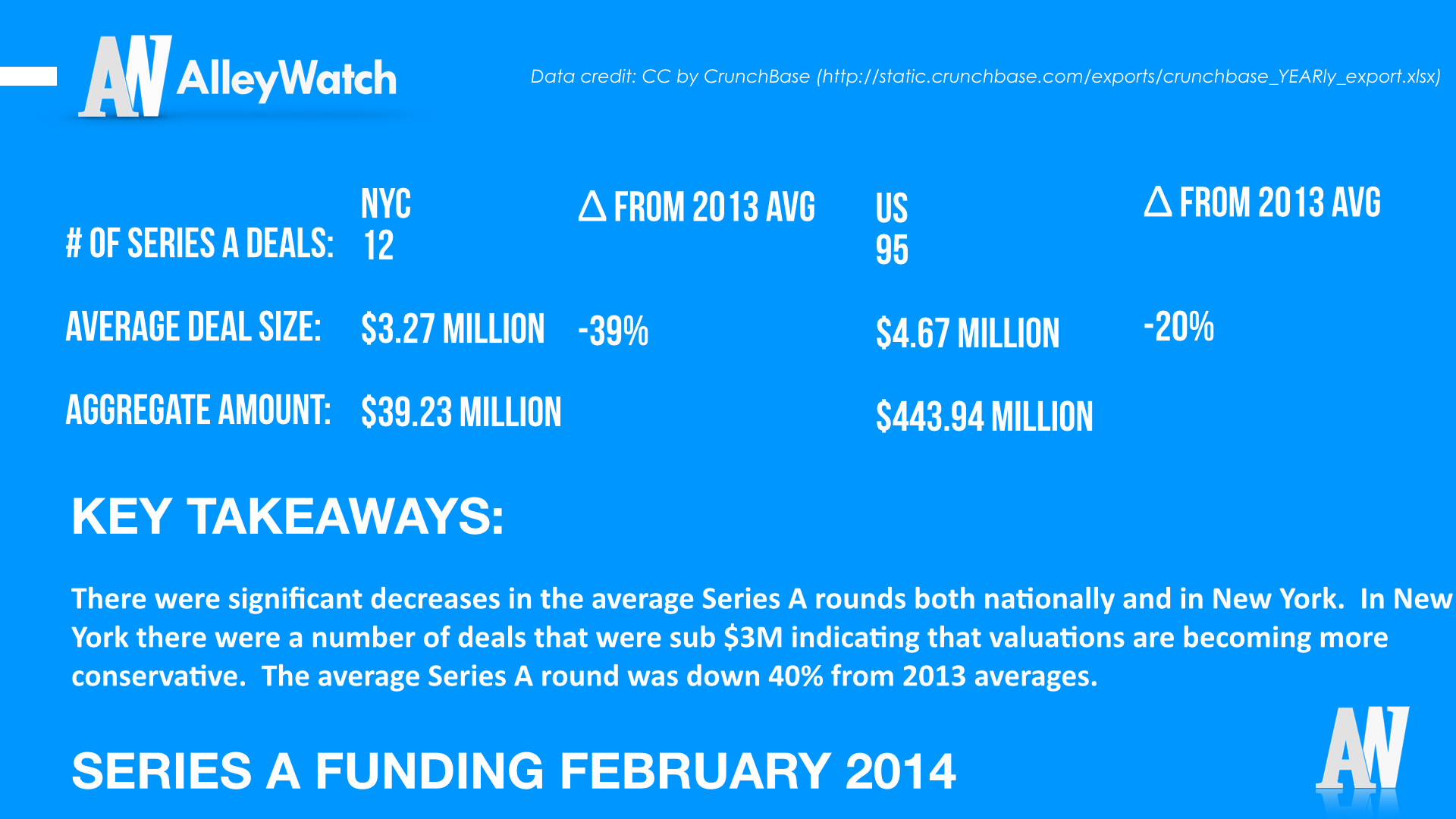

Key Takeaways:

There were significant decreases in the average Series A rounds both nationally and in New York. In New York, there were a number of deals that were sub $3M indicating that valuations are becoming more conservative.

For your tweeting convenience:

Average Series A round in NYC for February was $3.27M Tweet this

Average Series A round in the US for February was $4.67M Tweet this

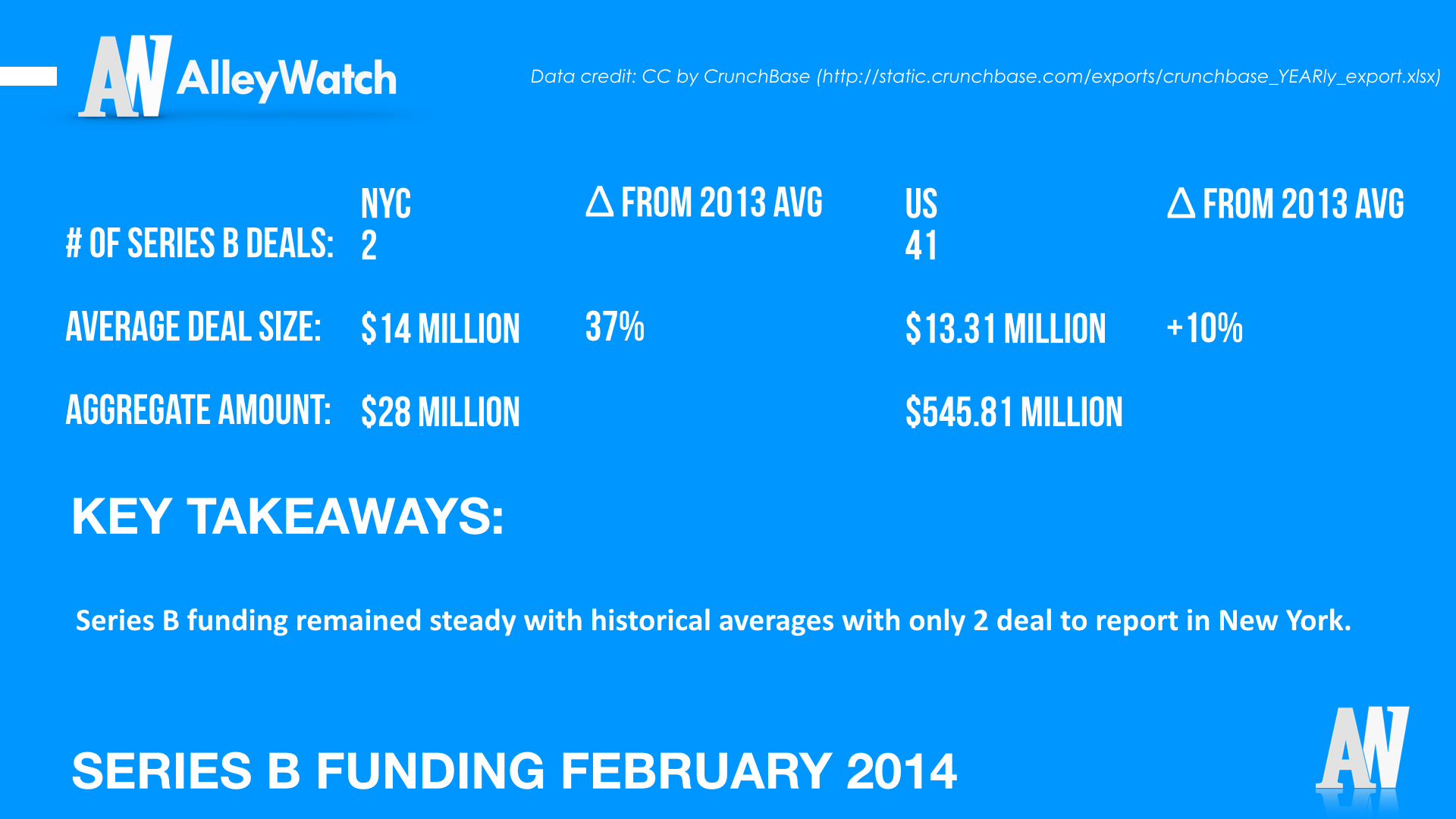

Key Takeaways:

Series B funding remained consistent with historical averages with only 2 deals to report in New York.

For your tweeting convenience:

Average Series B round in NYC for February was $14M Tweet this

Average Series B round in the US for February was $13.31M Tweet this

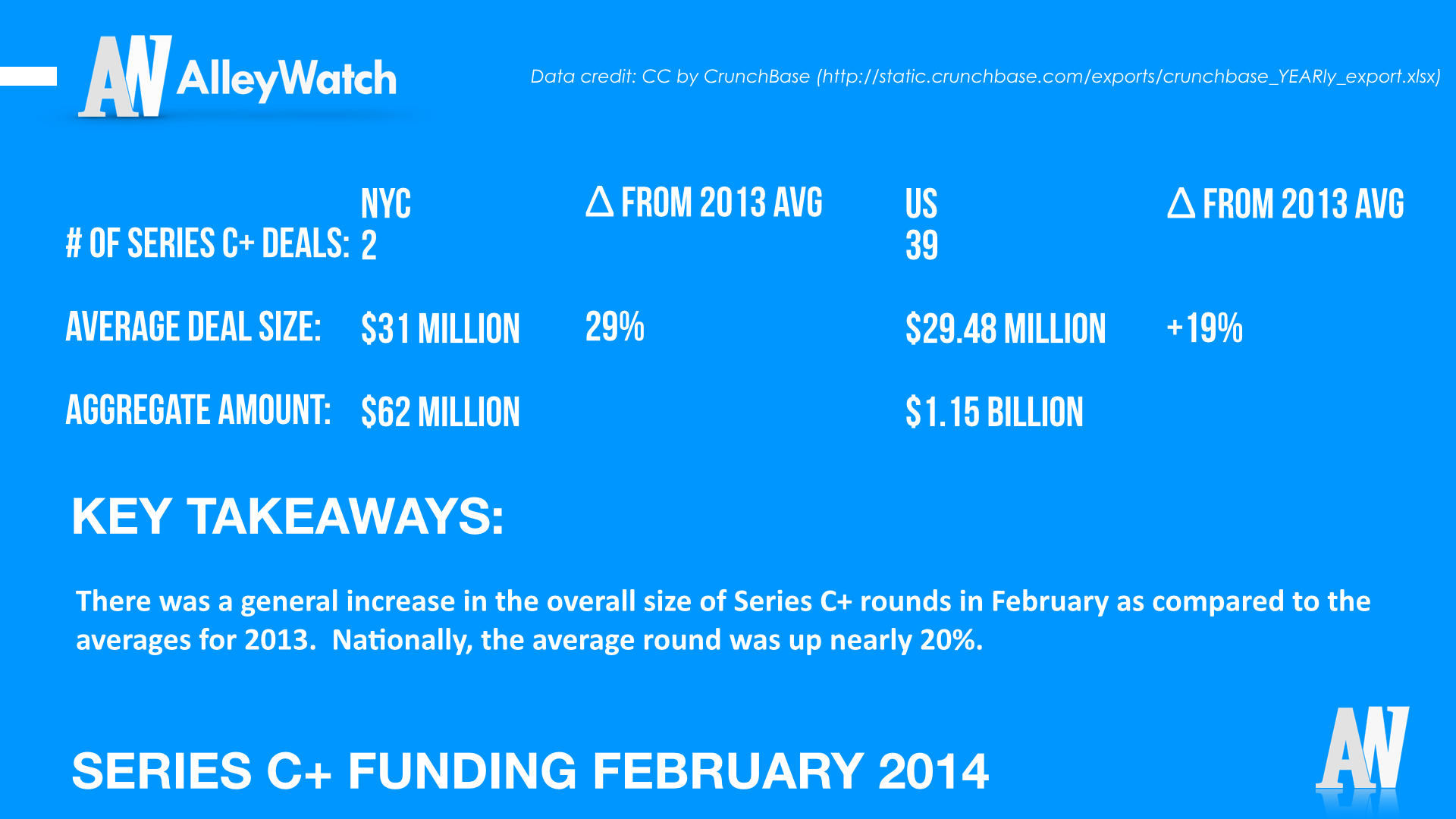

Key Takeaways:

There was a general increase in the overall size of Series C+ rounds in February as compared to the averages for 2013. Nationally, the average round was up nearly 20%.

For your tweeting convenience:

Average Series C+ round in NYC for February was $31M Tweet this

Average Series C+ round in the US for February was $29.48M Tweet this

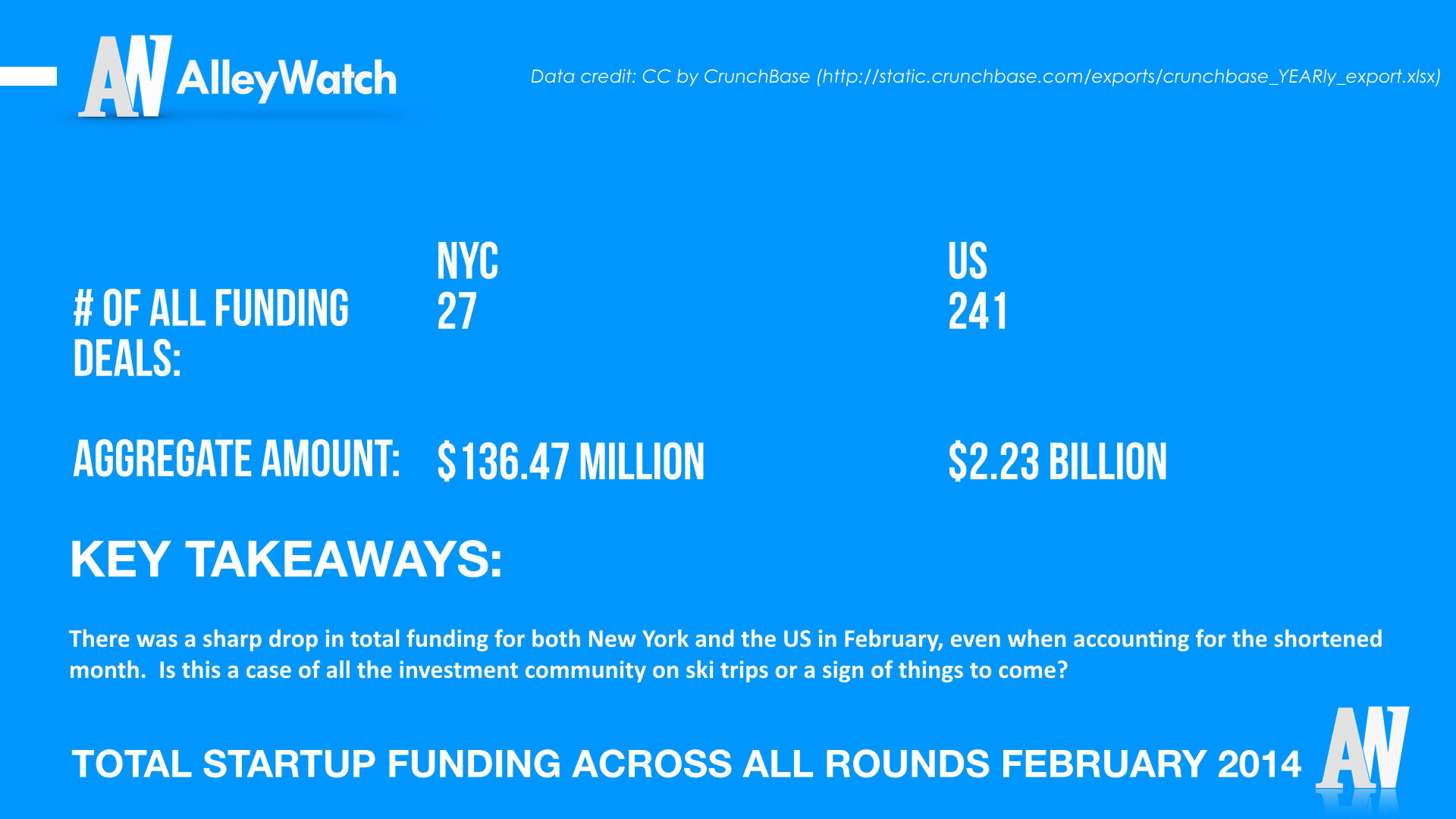

Key Takeaways:

There was a sharp drop in total funding for both New York and the US in February, even when accounting for the shortened month. Is this a case of all the investment community on ski trips or a sign of things to come?

For your tweeting convenience:

$277.34M was invested in angel and venture financing for #startups in February in NYC across 27 deals, down 51% Tweet this

$2.23B was invested in angel and venture financing for #startups in February in the US across 241 deals, down 20% Tweet this