Thinknum is a web platform that basically indexes the world’s financial information by enabling investors to collaborate on financial analyses, aggregating the abundance of financial data and insights out there and presenting it to users in an intuitive format. Chief Thinknum and Doer Justin Zhen is here to tell us more about the platform.

Tell us about the product.

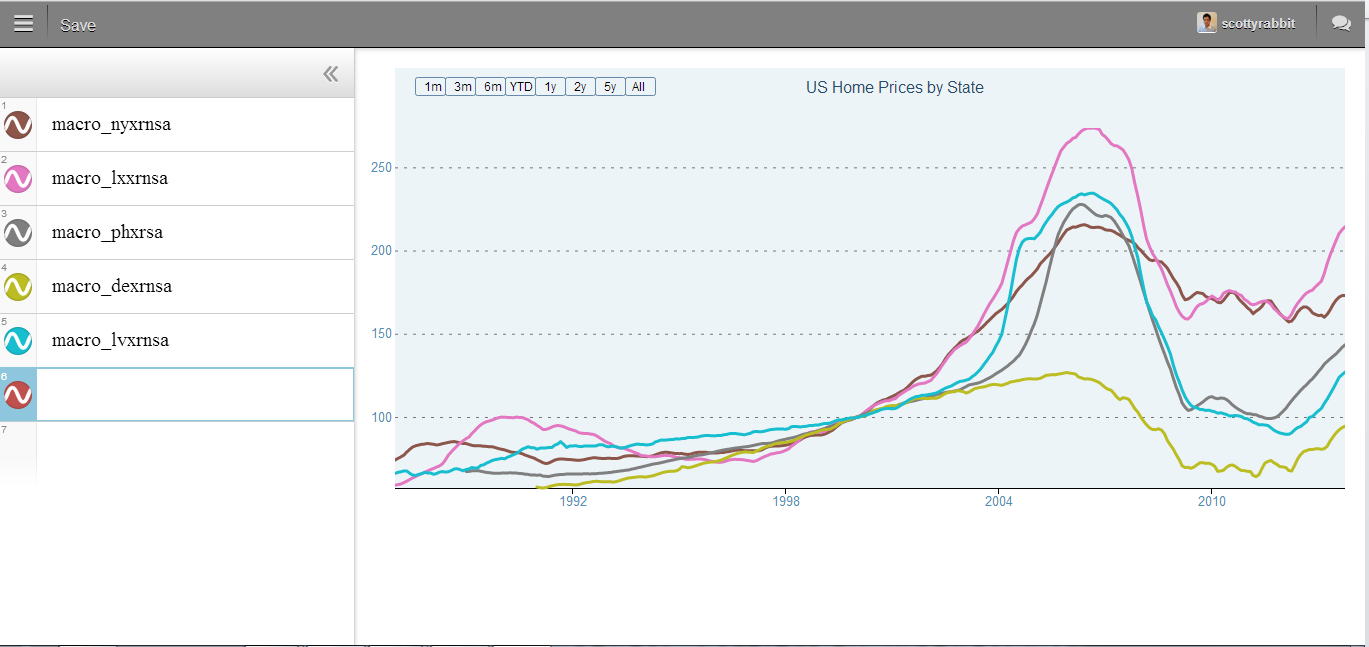

Thinknum is an open collaborative web platform for financial analysis. There is an abundance of financial data found on the web, but it comes from many disparate sources that do not play well together. Our mission is to aggregate this data onto one platform and provide tools for investors to create, share, and collaborate on financial insights.

How is it different?

When we worked in finance, my co-founder, Greg, and I noticed that many analysts still manually update spreadsheets and email them back and forth. This process is quite inefficient and mistake-prone. In 2012, a JP Morgan trader known as the London Whale actually lost over $7 billion, partially due to copying and pasting incorrectly in Excel. Thinknum’s financial models are hosted on the cloud, and they automatically update with new data.

Moreover, Thinknum is radically open. The platform is designed for all types of investors, from the retail investors to hedge fund traders. We believe that by creating a larger pool of insights, the best ones will rise to the top. Thinknum is a channel for a domain expert in Malaysia to share her expertise. In the process, we are indexing all of the financial information in the world.

Thinknum

The financial data market is $25 billion. Current data providers have primarily built their infrastructures on local desktop software solutions. Thinknum is utilizing the web’s collaborative and technological resources to create a more dynamic and open platform for financial analysis.

The FinTech space is very hot. Where do you see it going over the next few years?

The rise of Web 2.0 platforms that emphasize sharing and collaboration has exploded in recent years and will continue to do so. Furthermore, we are witnessing a shift in enterprise technology utilizing cloud computing, which is significantly more powerful than traditional services. Thinknum is taking full advantage of these paradigm shifts and bringing the web’s innovations to finance.

What is the Thinknum business model?

Thinknum is free for users whose analysis remains public for others to use. Since many hedge funds and other institutional investors do not like sharing their proprietary models, we monetize by selling them subscriptions to keep their analyses private. Thinknum also provides additional features to paying users, such as distributed computing and custom applications built on top of our platform.

Why is your team the right one to get the job done?

I met my co-founder, Greg, at Princeton eight years ago. I majored in financial engineering, while he studied mathematics. After graduation, I went to work for a hedge fund, while Greg went to Goldman Sachs. The problem that we are solving lies directly at the intersection of finance and technology, and we possess extensive domain expertise in both areas.

What are the milestones that you plan to achieve within 6 months?

We will continue to add innovative features while growing our user base and getting extensive feedback from them. As always, our mission is to keep building something that they love.

If you could speak with one investor in the New York community, who would it be and why?

We would love to meet David Rose. He has started multiple companies from the ground up. His insights are incredible, and he is an amazing teacher as well.

Why did you launch in New York and how has being in New York helped your company?

I was born in New York, but my family moved away when I was in fourth grade. It feels great to be back!

Of course, New York is the epicenter of finance. We are surrounded by tens of thousands of users and clients who we can market to and get feedback from. There is also an incredible ecosystem here among entrepreneurs. We couldn’t imagine building Thinknum anywhere else.