Recently, we covered how to perform due diligence on startups. This is obviously helpful whenever you’re assessing a startup and whether or not it’s worth a closer look for a potential investment.

So now, here you are, your friend wows you with his pitch. He has a rockstar team comprised of complementary talent. They have key advisors to add value, how they’re going to build their products, they legitimately know what their go-to market strategy is, who their audience is, and a concrete method on how they’re going to make money.

As the entrepreneur, you are ecstatic and prideful of your ability to sell your vision. But now, here’s the hard part: Getting the investor to sign the dotted line. How much are you willing to give up in your company? Are you even ready to take on outside capital? How do investors view your startup from a finance point of view? Should you go the angel route or the Venture Capital route? How does Venture Capital even work?

As angel investor, armed with confidence, optimism, and faith you are ready to write the check. But you are a little out of tune with how the startup investing world works.

It’s important for both sides of the table of the startup to understand basic fundamentals of startup finance. So let’s get started.

Non-Equity Financing

- Self financing/Bootstrapping

- Debt/Bank Financing

Equity Financing

- Angel Financing

- Venture Capital

- Strategic Financing

Self-Financing/Bootstrapping

- Financing growth from previous cashflow and personal funds or sometimes family

- Example

- Often good bootstrapped companies emerge from a service or consulting companies that are productizing their offering.

Successful startup entrepreneurs often self-finance or bootstrap the Early Stage

Things to Think About

- Bootstrapped companies almost always spend cash more effectively than equity financed companies

- If they are coming out of the service business within the same vertical, they should understand the market

- No outside influences driving startup to places the business shouldn’t/doesn’t want to go

- Resources for product and market are constrained by cash flows or size of pockets, but this is a good thing

- May miss a big opportunity if other players raise finance and invest heavily, but this is mostly a head fake

- A founder has to take on all/most of the risk

Debt/Bank Finance

- Relatively limited funds are available

- Banks only lend to businesses they can understand and they understand very little in the startup world

- Process is slow and painful

- Almost always need a personal guarantee

In a nutshell, banks are completely worthless in the startup world. And regardless, you should never be starting your business off on a loan. Check out the video below, where Mark Cuban discusses how taking out a loan is moronic.

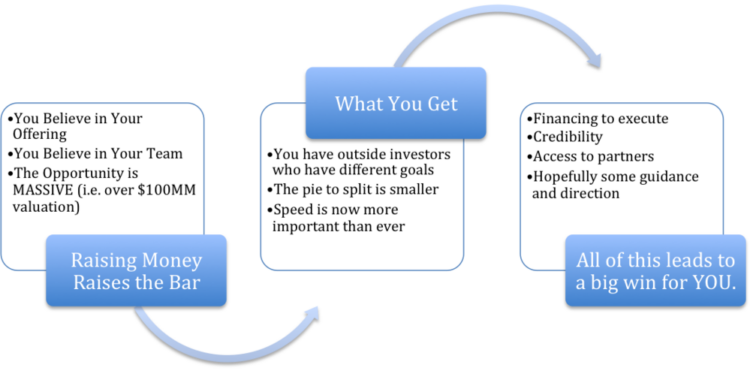

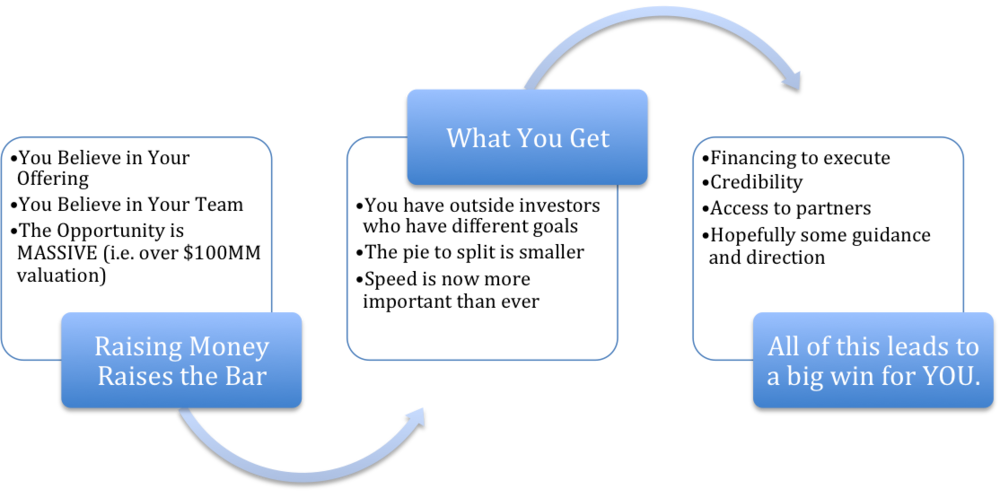

Why Should I Raise Outside Capital?

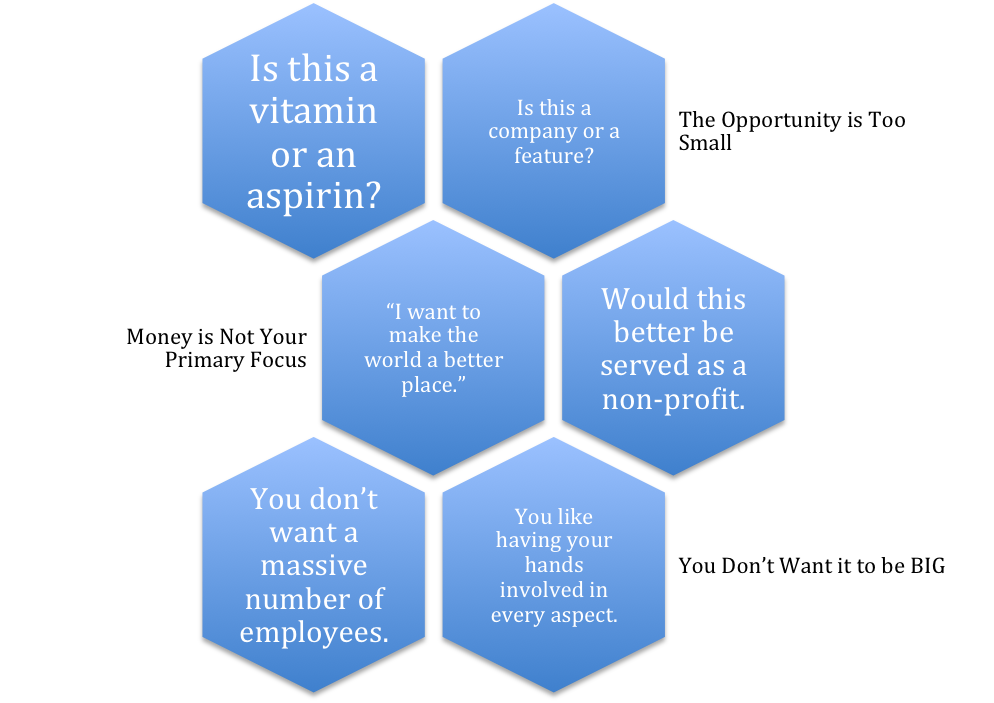

When to Not Raise Outside Equity Financing?

What Happens When You Raise Money When You Shouldn’t

- You let people into your business who are not aligned with your goals and dreams.

- You will be working at something you may not like for 3 to 7 years and doing it for little pay.

- Can’t do a small exit and call it a win.

- Almost always means you will be raising money forever.

- You have lost control of the business when you didn’t want to.

Venture Capital – What is a VC?

- Raise a fund from groups/people: Pension funds, financial institutions, and rich individuals. These groups/people are known as “LPs”, “Limited Partners”.

- General Partners are the managers of the fund, who receive a management fee and carry (see below)

- Most funds will eventually have to close the fund and send a return to the investors.

- The one exception is evergreen funds.

- Evergreen funds remain open and continuous – They are usually family investment funds

- Venture funds invest money over 3-5 years with the hope that a fund may close in 7 to 10 years

- 5/8 of investments lose money and go to near zero

- 1/4 of investments basically break even

- 1/8 of investments are homeruns and make lots of money

VCs Make Profits through Two Ways

- Management fee on funds managed, usually 1 to 2.5%

- This is used to pay salaries and cover overhead

- Carry on the profits of the investment 20 to 25%

- This is where investors make the real money as bonuses or large returns

VC Money Making – An Example

- VC Firm “Tech Fund” raises a $100MM fund in 2010 – They call it “Tech Fund 2010 LLC”

- 2% annual management fee

- 20% carry

- Between 2010 and 2015 they make 10 investments for $10MM each

- In 2018, all of the investments have reached some liquidity event

- 5 went out of business and returned nothing = $0 total return

- 3 returned 10% profit = $33MM total return

- 2 returned 800% profit = $180MM total return

- $213MM total return

Tech Fund 2010 LLC’s Outcome

- $113 MM gross profit for the fund

- $16 MM in management fees

- $22.6 MM in carry

- $174.4 Returned to the investors (limited partners)

Angels – What Makes Them Tick

- Angel = Probably a rich person who has USUALLY been successful in the startup world.

- Unlike the VC, an Angel invests their own money

- Two successful exit scenarios for an Angel

- Startup might be sold quickly for a relatively smaller amount of money (i.e. single digit millions of $$$s) and the Angel can make a quick multiple on his/her money back

- Startup raises VC money, but has built up interest into a venture-backed startup that is going to shoot for a homerun. In many ways, they are at the same risk of dilution as the founders unless they keep investing.

- A vast majority of angels do not invest to make money. They do it just so they can be part of the action or to “be in the game”.

Angel and VC Equity Financing

- Almost all startups have to raise equity-based financing at some point if they comply with “Why should I raise money” (see above).

- The key to raising equity-based capital is knowing when to raise it.

What is a Strategic?

- Strategics are large company or organization that is in the vertical or distribution chain target for a startup (e.g. Exxon Mobil would be a strategic for a startup building an oil and gas searching schematic software product)

- They invest to help innovation and lock out competitors

- Things to think about:

- Pros

- Gain instant credibility

- Can help with a distribution channel

- Can occasionally add technical help

- Cons

- Often caps your backend potential

- This usually means that your valuation can get capped versus growing organically – which given the scenario could more opportunities to grow and scale

- Sometime you may essentially get swallowed into a massive system – which may limit fluid movement and creativity

- Can close off opportunities

- Pros

Key Terms that You Will Hear and Need to Know

- Convertible Note – A loan that will convert into equity (with a discount and interest) with the next major financing round

- Term Sheet – The document that investors sign that describes the terms of the financing

- Cap Table – The capitalization breakdown of a company. Who owns what percentage of the company

- Pre-money Valuation – How much is a company worth before a financing takes place

- Post-money Valuation – How much is a company worth after a financing takes place

- Liquidity Preferences – An investor’s right to be paid back at a certain rate on a successful. (Example: 2X liquidity preference)

Well that’s a wrap. I understand that this may be rather high-level. In a later post, I will go more in detail in the different stages of startup financing.

Keep hustling my friends.