For the past several years I’ve been making comparisons between the dotcom bubble and this current tech cycle. At this point, that we’re in a period of exuberance (be it rational or otherwise) is a given (26 year olds don’t sell companies with little revenue for $1.1 billion in cash unless something awesome is happening – and FWIW I think the Yahoo/Tumblr deal is a win all around). But in July 2011 I said, “The question isn’t, ‘Are we in a bubble?’ The question is, ‘Are we in 1995 or 1999?’” The question, therefore, remains: At what point in the cycle are we? The answer: It’s still early. Here’s why…

The Dotcom Bubble.

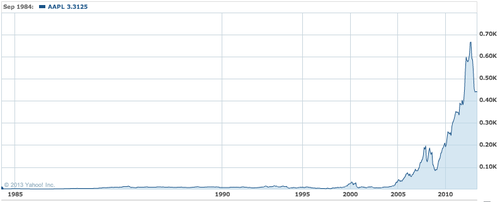

Wikipedia says the bubble was between 1997 and 2000 with the peakMarch 10, 2000, when the NASDAQ topped 5132. (I remember it vividly – I was an Internet analyst/banker then.) Massive carnage followed, and the NASDAQ still hasn’t reached those levels, despite unprecedented numbers in nearly every other index. That said, the single largest creation of value in the “Internet space” (in a single company) was Google. And guess what? Google “happened” after the bubble burst. (The IPO happened in 2004, and its largest growth in traction, valuation and every other metric happened thereafter, as well.) Similarly, the bulk of Amazon’s valuation gain was post meltdown, as was Apple’s. (I’m cherry picking here, but for good reasons – not the least of which is that these examples validate my argument.) Pretty charts:

The reason that this happened (and in all seriousness) is that the things that the web and these companies let us do really only gained mainstream ubiquity after the bubble burst. For example, Internet penetration in North America in 2000 was around 30 percent – for real. 30 percent. Today it’s close to 80 percent and effectively ubiquitous. Good growth. And forget about broadband penetration. In 2000 we didn’t Google everything – in fact, Google was barely a company, let alone a verb. Internet retail penetration is still probably less than 10 percent, and it was even teenier a decade ago.

Fast forward…

Yes, the Facebook IPO sucked initially for the IPO investors (though raising $10 billion at a nice valuation is a success for the company in my book). And Groupon, Zynga, et al fizzled. And someone made a movie about all this already. But…

Smart phone penetration is still around 50 percent, and that will double, which means that an additional 120 million U.S. mobile accounts will get smartphones and pay an additional $20/month for data service – that’s $25 billion in incremental revenue, much of which falls straight to the bottom line. Usage will continue to go bananas and, therefore, growth will be exponential/geometric. Social media penetration is much higher than 30 percent in the U.S. (probably double that or more), but believe it or not, it’s not yet functionally ubiquitous. But it will be. Mobile web traffic is only now starting to eclipse desktop web traffic. Personal cloud services have barely scratched the surface. Local search and location-based services are still in their infancy, but eventually everyone will use mobile apps to find, book, check-in, order, pay and return to restaurants and other retail establishments. And Square has nice commercials, but barely anybody uses real mobile payments – yet. Etc. Etc. Etc.

Bottom line: It’s still early. I’m still bullish. And you should be, too. Otherwise, you’ll miss the best part: now.