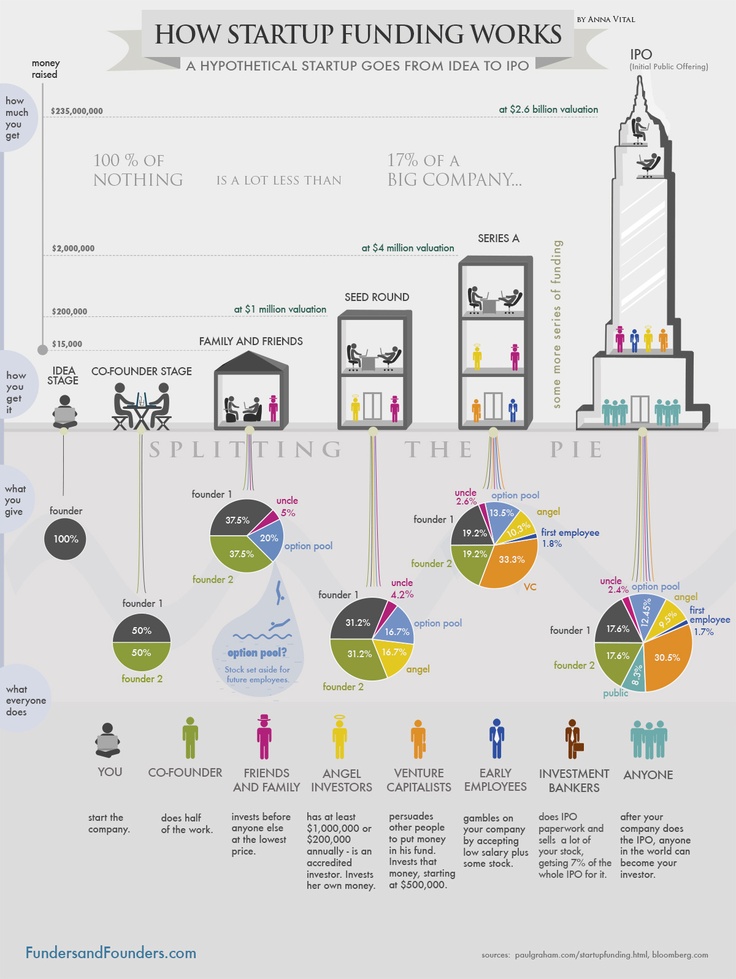

Anna Vital from Founders and Founders explains how a startup can go from an idea to an IPO in the infograph, “How Startup Funding Works.” Have $15,000 and an idea? You can start your own company! Don’t want all the responsibility? Find a co-founder and you can split the work 50/50. Then, find some family and friends to invest for cheap before anyone else has a chance to set your idea in motion. This is also a good time to make an option pool and set aside stock for your future employees.

Next up: the seed round. You have found accredited angel investors to give you their own money, and even though your percentage of the company has dropped to around 31% , your $15,000 has turned into $200,000!

Then you find venture capitalists – people who have persuaded other people to put money into his or her fund during Series A — the first really significant round of venture funding. The VC now has 33.3% and you and your partner each have 19.2, but your company is now valued at $4 million. It is also the time to hire your first employees — they take a chance on your growing company by accepting a low salary and some stock.

After several more series of funding, investment bankers complete your Initial Public Offering paperwork and sell a lot of your stock. Finally, when your company does the IPO, anyone in the world can become an investor. You end up with 17.6% of the company, but your slice of the pie is now worth around $458 million. And as Vital says: “100% of nothing is a lot less than 17 percent of a big company.”